Business Insurance in and around Pittsburgh

One of Pittsburgh’s top choices for small business insurance.

Almost 100 years of helping small businesses

State Farm Understands Small Businesses.

Running a small business comes with a unique set of wins and losses. You shouldn't have to face those alone. Aside from just your loved ones, let State Farm be part of your line of support through insurance options including errors and omissions liability, business continuity plans and worker's compensation for your employees, among others.

One of Pittsburgh’s top choices for small business insurance.

Almost 100 years of helping small businesses

Protect Your Business With State Farm

At State Farm, apply for the excellent coverage you may need for your business, whether it's a veterinarian, a florist or a pet store. Agent Jeff Huntington is also a business owner and understands what you need. Not only that, but customizable insurance options is another asset that sets State Farm apart. From one small business owner to another, see if this coverage takes the cake.

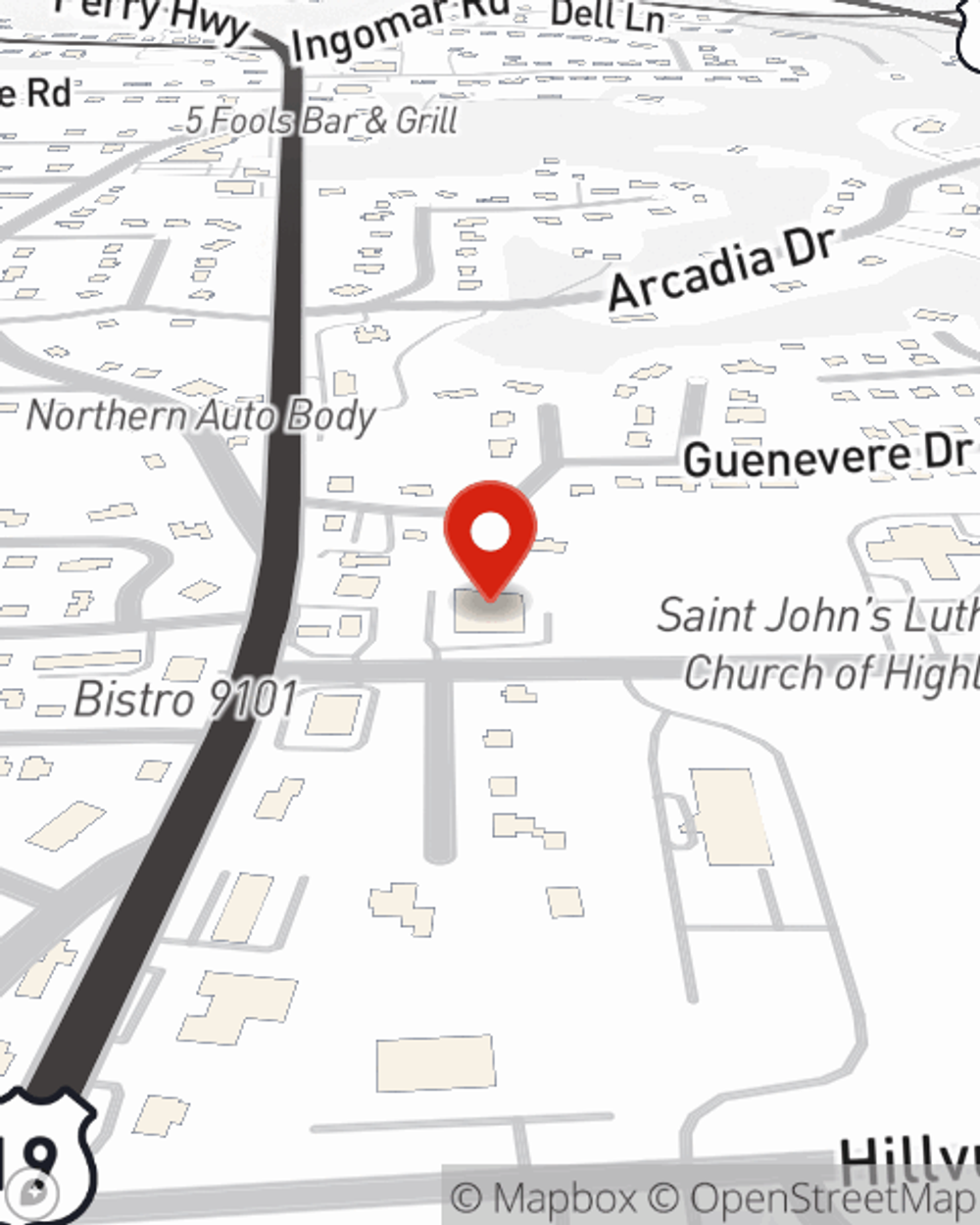

Get right down to business by visiting agent Jeff Huntington's team to discuss your options.

Simple Insights®

Small business types

Small business types

What is a sole proprietorship, an LLC and other small business types — and which one is best for you?

What are typical landlord maintenance responsibilities?

What are typical landlord maintenance responsibilities?

As a landlord, there are certain maintenance responsibilities associated with the property. Equip yourself to better address repairs while minimizing preventable issues.

Jeff Huntington

State Farm® Insurance AgentSimple Insights®

Small business types

Small business types

What is a sole proprietorship, an LLC and other small business types — and which one is best for you?

What are typical landlord maintenance responsibilities?

What are typical landlord maintenance responsibilities?

As a landlord, there are certain maintenance responsibilities associated with the property. Equip yourself to better address repairs while minimizing preventable issues.